Forgot Your Password?

Just enter your account email here

to have the password sent to your email.

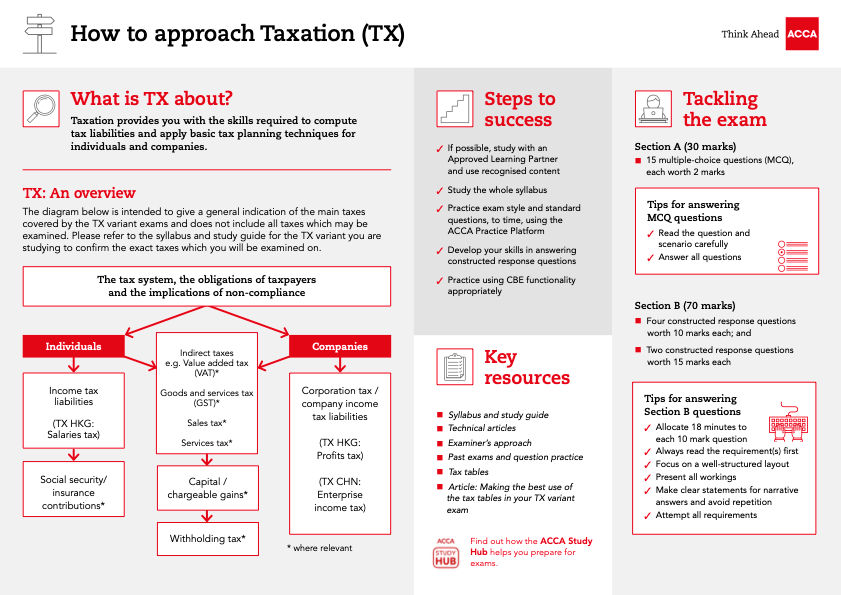

The Applied Skills level subject for Taxation is a session based computer exam taken within any of the 4 windows during the year (March June September & December). Applied skills level subjects can be taken in any order.

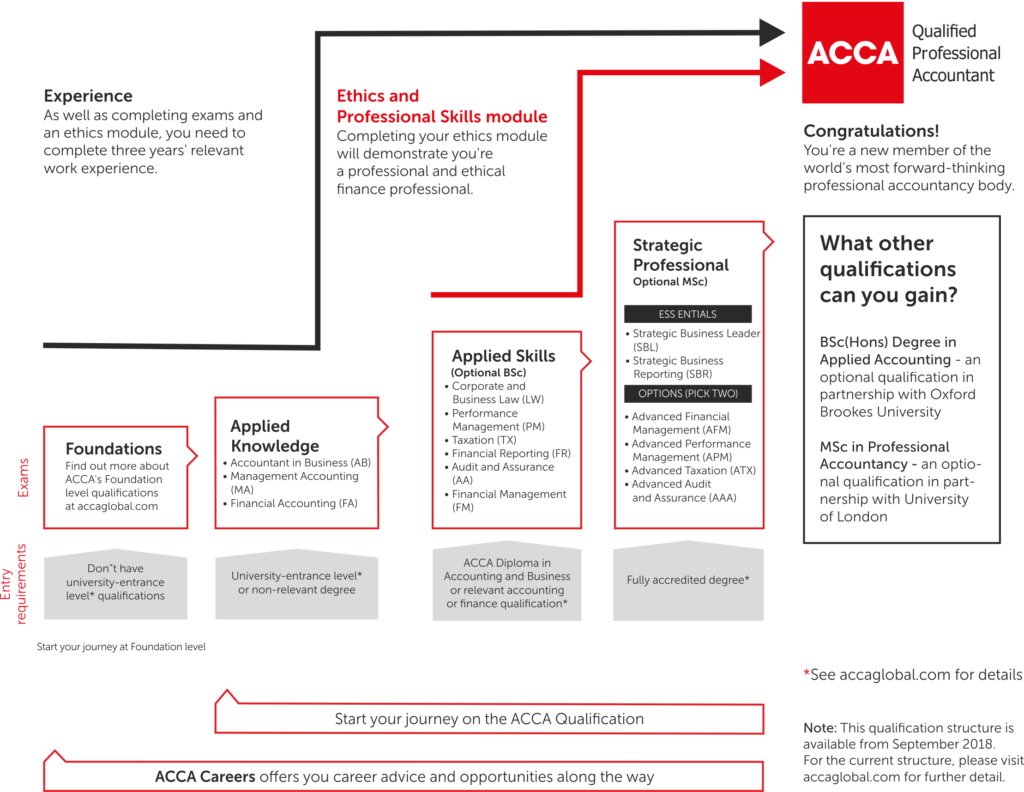

You may qualify for exemptions which let you start your studies at a level that is consistent with the knowledge and skills gained from prior learning. They provide you with the quickest route to ACCA membership.

Click below to establish any exemptions you may be awarded along with further information and important dates.

➠ Entry requirements➠ Exam exemptions ➠ important dates ➠ acca fees ➠ booking exams ➠ exams Timetables ➠ more faqs

Don't Forget! As part of your journey to become an ACCA member, you must demonstrate relevant skills and experience within a real work environment. This is what ACCA's Practical Experience Requirement (PER) is all about.

To complete ACCA and gain membership you will need to achieve 36 months of supervised experience. This should be in a relevant accounting or finance role.

DOWNLOAD THE PER GUIDe FIND OUT MORE ABOUT PER here

READY TO MAKE A START with rca?

Step right in and start your ACCA & RCA journey. RCA run all courses twice yearly to help keep you moving through the ACCA qualification with classes running during the spring and autumn terms fro TAX

"IT'S YOUR TIME TO SHINE"

Just enter your account email here

to have the password sent to your email.

This site uses essential cookies for parts of the site to operate and have already been set. Find out more about how we use cookies and how you may delete them HERE. You may delete cookies, but parts of the site will not work.

Input your email address and click the subjects you are interested in for free emails with study guidance, tips and other resources.